A New Breed of Payment Organization

VASU strives to bridge financial infrastructures, advance emerging markets, provide transparency, increase security, reduce costs and speed up global value transfers for all

We aspire to provide streamlined globally regulated, fully compliant financial technology solutions to centralized AND decentralized communities

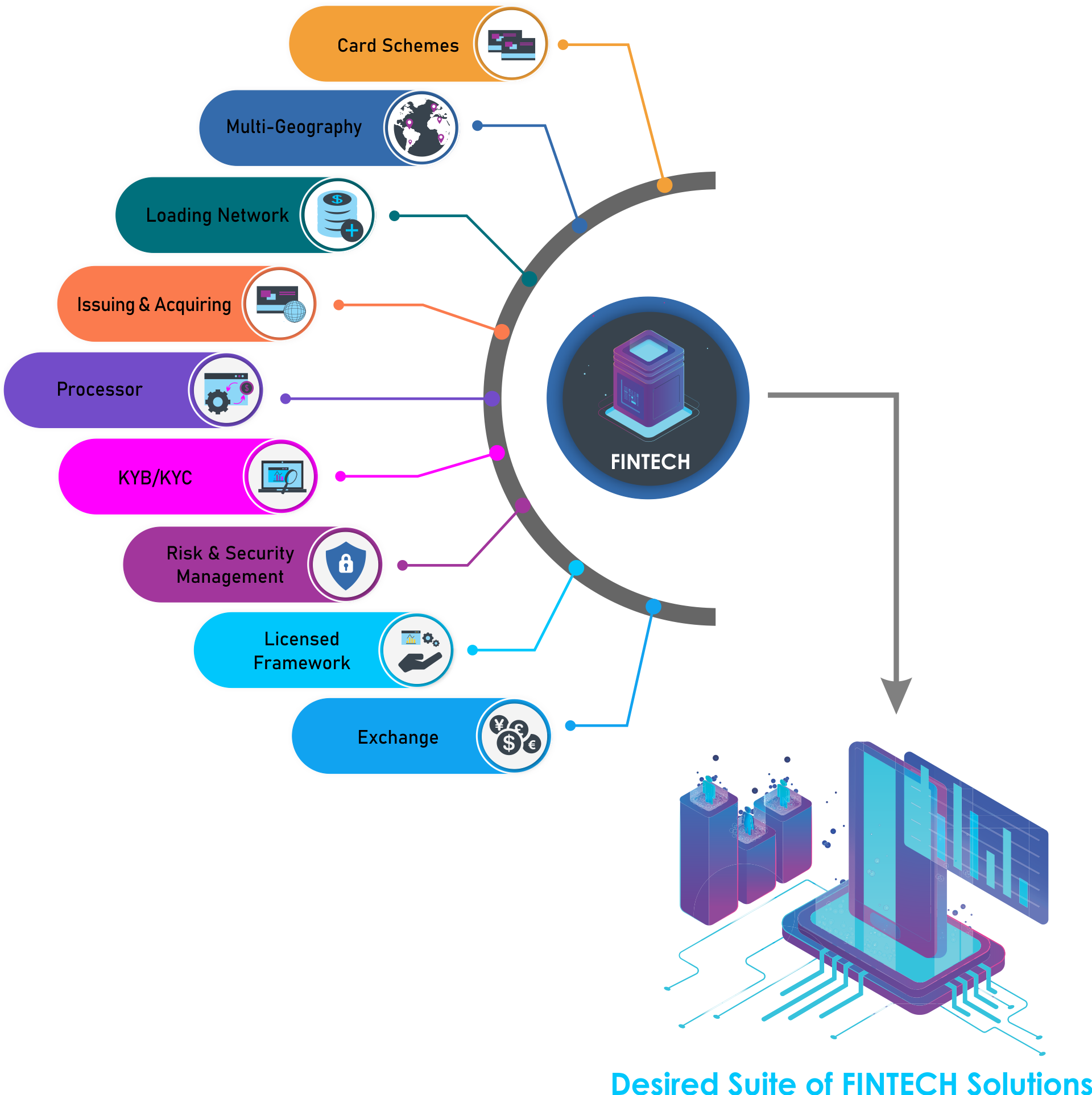

Global Network Ecosystem

Merchants encounter a variety of issues when seeking to secure and execute a multi-faceted international payment strategy by way of a “Desired Suite of Fintech Solutions”

There exists an incredibly complex legal and regulatory framework, requiring huge amounts of time and investment capital

Licensed and headquartered in SE Asia, VASU provides a superior and distinctive international nexus point of economic, geographic, demographic and operational advantages to worldwide merchant clientele. VASU is today reputationally positioned as a “provider of choice” for global businesses seeking a diversity of customized universal payment channels.

Our Team

FOUNDERS

Since 2020, our Founders have worked together to establish, secure and streamline the infrastructure and strategic business relationships to now effectively and immediately execute our business model. Each Founder has invested vast time, technical and/or personal capital resources to the overall enterprise development cycle.

Chris Aldaba

President & CEO

Christopher Aldaba is a highly recognizable and respected global FINTECH professional with nearly two decades of international experience. His worldwide network of clients and organizations in the FINTECH and banking sectors, covers Asia, the Middle East, Europe, and North America. In such geographies he has been personally responsible for oversight and successful receipt of over 20 different regulated payment license categories covering EMI, Virtual Currency, and Global Remittance, while further securing card issuing and acquiring approvals in the Philippines and Singapore with the Card Schemes (of Visa, MasterCard and China Union Pay).

Kiran Sharma

CMO & Founder

With over 10 years of work experience spent primarily in S.E. Asia, she has been the spearhead and driving force behind strategic global business development relationship engagement and merchant outreach initiatives. She is certified in ‘Fintech Innovation and Transformation in Financial Services’ from the National University Business School in Singapore, and her direct experience provides her with knowledge of worldwide license and regulatory requirements that govern international and cross-border payment transactions. In 2024, she was named in India as a “Women Leader in Finance in Asia” and recognized as a “Stellar CXO Award” recipient for Marketing prowess in the Philippines.

Global Coverage

Stability – Trust

and Support

Local Expertise

Bespoke Payment Solutions

Vasu International Payment Solutions Inc., is the core member of a conglomerate of international payment organizations collectively and collaboratively offering a diversity and multitude of global payment products, services and solutions.

Our enterprise companies represent together represent a substantial global licensed ecosystem of issuers and acquirers, exchanges, PSP, ISO, and Cryptocurrency organizations around the World with internal group offices and operations in the Philippines, Australia, Cyprus, Lithuania, Dubai, Brazil, and Canada.

From customized payment gateways to flexible processing options, advanced fraud protection, and comprehensive reporting, our proprietary worldwide financial ecosystem provides our partners with a truly seamless, secure, and customizable payment experience.

*** Services and solutions offered through Vasu International Payment Solutions Inc., are subject to business approval, geographical availability, and regulatory authorization, and there is no guarantee that the product will become available in a specific timeframe, or to a specific customer group or geography. You should carefully conduct your own investigations and analyses in connection with any participation with the services and solutions, including your objectives, risk factors, fees, and expenses and the information set forth in these materials. All prospective users of the services and solutions described herein are advised to consult with their legal, accounting and tax advisers regarding any potential participation. Services and solutions are subject to change pending availability, regulatory approval, and market conditions. Additional information is available upon request